It is the time of the year again for our highly anticipated oil price related predictions for 2018.

So, without further ado, here are our five oil prices predictions for the year 2018.

Russia extends its influence on oil prices and OPEC

You may have read about ‘OPEC and Russia,’ a lot more in recent times. How fares the union? Well, it’s a rather novel – about two years old – alliance based on the aligned interest between the nations to control global oil prices. However, other opposing factors will act as a dampener on this duo in 2018. Yes, the alliance is new and ambitious but brittle. Already, signs of strain are rather too apparent. In 2018, it will sour in glorious ways. Together, OPEC and Russia account for about 40 percent of global oil production. As to that, one can imagine the ramification of any deal between these two.

Strategically, on the military side, Russia and Saudi Arabia are – quite frankly – enemies. Russia does not want a pipeline through Syria (which Saudi Arabia and Qatar sponsored). Russia supports Iran and Syria (Shia Muslims). On the other side, Saudi Arabia vehemently opposes Syria and Iran with the unconditional military support of none other than USA. More importantly, OPEC has operated for years as a pyramid with Saudi Arabia ruling the roost as a despot with unilateral decisions on cuts with little to no opposition. Russia may conciliate for a while but unlike the Arab countries forming OPEC, Putin’s Russia does not take orders from anyone.

At the recent Nov. 30 OPEC meeting, Russia demanded the cartel’s quotas be re-evaluated based on current market shares. This is because historically production q

uotas are pegged to “proven” reserves. Unofficially this “quota formula” has allowed Saudi Arabia to sell more oil than other members by claiming enormous reserves while, conveniently, the monarchy does not allow any foreign audit. Now Russia – with larger proven reserves – is weighing in on the OPEC quotas and a re-calibration is in order if OPEC wants Russia on the boat.

For now this marriage of convenience between Saudi Arabia and Russia will subsist but there will come a time when roles will be reversed. Already, Russia has established control over a lion’s share of Venezuela’s oil resources. In addition to that, the ongoing financial turmoil in Saudi Arabia will likely open the door for Russia’s influence on OPEC quotas.

Of course, Saudi Arabia received a positive jolt with Russia backing supply cuts (by about 1.8 million barrels per day) for the entire 2018. Yet, one has to look into the joint OPEC and Russia communiqué that hints at a revisit to the agreement based on market conditions prevailing on June 2018. Point is, Saudi Arabia needs Russia, more than the other way around, for political, economic and strategic reasons.

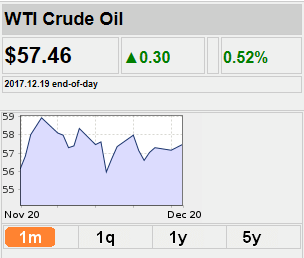

Given that Russia’s oil production has surpassed Saudi Arabia, the Saudi monarchy desperately needs Russia’s backing in order for OPEC quotas to have any effect on oil prices. For good measure, since Russia came on board, the global supply glut reduced by about 25%. Oil prices have been relatively stable around $50 a barrel throughout 2017. Much of this stability is due to OPEC’s inability to rein in non-member Russia without concessions. Should OPEC provide discounts to Russia and if Putin’s country agrees to reduce its output, we predict that oil prices may breach the $70 mark in 2018.

Saudi Arabia loses influence, faces turmoil

We predicted last year that turmoil would wash over Saudi Arabia in 2017 if the country continued to spend (and speed) through its cash reserves at rates unsustainable in the face of $50 oil prices. After all, Saudi Arabia needs oil at $80 to balance its budget. What’s happening as 2017 draws close and 2018 arrives in Riyadh too?

Sure, we’ve read about the considerable social reforms initiated by the Kingdom along with elaborate and progressive economic overhauls including the major drive to privatize state owned oil company, Saudi Aramco. In fact, much has been published about this recent “Saudi purge” but with very little insight. Peculiar as it sounds, fact is, very little news makes it out of Saudi Arabia on any matter, which should come as no surprise. Let us not forget that the Kingdom is the last standing absolute monarchy, a theocracy with freedom of press rivaling that of North Korea.

Indeed, former Goldman Sachs chairman Jim O’Neill recently stated that, “The Saudi government has been implementing radical changes, both domestically and in its foreign policy, and its reasons for doing so are not entirely clear”. Let us shed some light on this:

The Saudi purge, culminating in the arrest of Al-Amoudi – second richest man in the Kingdom – as well as billionaire prince Al-Waleed bin Talal is publicized by the Riyadh’s new ruler as an “anti-corruption sweep”. Please take note: anti-corruption rather than anti-terrorism.

This is the same semantics used by clerics of Wahabi mosques extorting – successfully – indoctrinated youths to join and fight for ISIS against Western values they portray as corrupt and decadent. Alas, this has resonated well with tens of thousands of youths who join ISIS ranks to replace corruption with a pure version of Islam. As if.

Domestically this “anti-corruption” cleanup serves Saudi Arabia at least 4 purposes.

- Saudi Aramco’s Initial Public Offering (IPO) needs transparency if it’s to take place in 2018. This open secret of an IPO is long in the tooth, nearly 3 years in the making and is yet to be cleared. As a result, pressure for transparency in mounting. Unfortunately for the IPO, Saudi billionaires have been using Saudi oil revenues as a piggy bank for years – under the shell of Aramco – with little to no record book-keeping. As you know, public exchanges demand transparency from all company regarding their financial statements in order to list their stock. The high level purge forces the hands of recalcitrant big Aramco players to turn over their ownership before it’s too late so that the IPO can move as planned. Let’s not forget, Saudi Arabia needs this IPO (and the money raised) in its efforts to diversify and move away from an oil dependent economy.

- It’s a ‘hood and wink’ attempt. How? We’ll explain. It allows the new ruler to appease irate Islamists by playing the righteous anti-western-corruption routine once again at a time when the country is cutting social benefits due to budget constraints, by seizing the assets of Saudi billionaires with a lavish western lifestyle.

- In many ways, the alleged ‘purge’, presents to western media a vague message, free of religious semantics, while implying – yet not stating – that the billionaires arrested had anything to do with corruption. Of course, the liberal leaning westerners, with their existing and preconceived negative perception of the oil & gas industry (and the Middle East) as extremely corrupt, readily approve of a crackdown on corruption. On the other hand, the conservative spectrum of western media outlets relayed this anti-corruption sting as a crackdown on terror funding. What’s not to like when blanks are filled out for you?

- The demand for 70% of rich detainees’ wealth in exchange for their freedom is a not-so subtle money-grabbing move by the new crown prince Mohammad bin Salman. With calculated steps, he is trying to salvage Riyadh from the quandary caused by decades of mismanagement. That how long he manages to postpone the Kingdom’s inevitable bankruptcy caused by unsustainable spending levels remains to be seen. Prince M.B.S., in the act of clean-up, is attempting to shore up the lifestyle of an unproductive workforce, amplified by an unsustainable population growth. This is another sign of unhinged desperation from the Kingdom’s ruler: arresting billionaires on charges of corruptions yet demanding billions in bribes for dropping the changes is extremely contradictory and reflects poorly on Saudi Arabia’s integrity.

As a bonus, most assets held by Al- Waleed bin Talal are in US companies which provides the Kingdom with much-needed diversification. To its credit, the Saudi Kingdom seems committed – for lack of other choices – to diversifying its economy. All the while, Riyadh has gradually lost control of OPEC since 2014; is being challenged by Russia as the number one oil producer; has turned against long-time ally Qatar, has not ramped up workforce productivity despite promises; has been delaying Aramco’s IPO; is wedging a war bordering on genocide, which it cannot afford, in Yemen; is running out of cash and has arrested Alwaleed Bin Talal – a talented financier with close ties to western politicians.All in all, not a good start for 2018. Yet, the worst is to come as it’s all downhill from here on.

Finance will bankroll long-term shift to electric vehicles

Teslas are cool. Electric is in. Recently, Elon Musk unveiled the all-electric Tesla semi trucks with a 500-mile range and semi-autonomous capacity, which will operate at a cost per mile, lower than rail. This is no small feat, as we previously reported, US rail’s ‘cost per ton per mile’ using diesel fuel is currently the lowest in the world. In fact Teslas have outsold Porsches for several years in California and as everyone knows California leads the way.

These electric trucks are set to “hit the road,” so to speak, in 2020, which gives those who believe in Elon Musk’s vision, an entire 2018 to invest, finance and build a network of charging stations needed for this electric fleet to operate.

Anyway, how likely are these stations to not only get funded but also built in 2018? Very likely, we say. Why? For the pretty obvious trust the names ‘Telsa’ and ‘Musk’ carry. Think about it. An American entrepreneur building American cars in the US using American labor! Reflective of the brand, Tesla repaid its federal loans 10 years in advance. Not to forget, Tesla made many of its patents public domain out of sheer altruism. What’s not to like about it?

And Tesla’s semi isn’t the lone horse at the stable. Cummins, a leading diesel and natural gas engine manufacturer, revealed a Class 7 electric truck named AEOS, last august itself. AEOS can support a 22 ton trailer. Nikolo Motor company, for its part, unveiled Nikolo One a hydrogen cell-powered truck, and soon followed it up with Nikolo Two.

These new generation trucks are good news for environmentalists. Globally, trucks account for about 8 per cent of green house gas emissions. However, as we pointed out earlier, these trucks need charging stations across the nation.

Now to the pressing question – who will invest in these stations?

We previously reported that during the period 2014-2016, financial institutions had increasingly favored funding unconventional fields over traditional oil exploration projects.

This was due to the near guaranteed payout from fracked wells which, when risk associated with low oil prices was factored in, made more financial sense than sponsoring expensive long-term offshore exploration projects. Pure economic sense, let’s say. In 2018 this “guaranteed payout” will motivate financial institutions to invest in the low-hanging fruits of the budding electric vehicle revolution. If not, won’t they “miss out” on the bounty up for the take?

So, are we going to see a radical paradigm shift? Put simply, no. We are not talking about a profound shift in funding from fracked wells to the EV industry but rather a substantial diversification from fossil fuels into EV, an industry which will, in the long term, take a significant bite out of the share of oil used in transportation.

Makes business sense, doesn’t it? With unrivalled money and influence, Oil & gas industry is the biggest in the world. Some perceive it as strength, others as an opportunity for disruption. 2018 will see the latter category access funding.

Well, right now, you don’t see Teslas at the gas station but don’t you see more of these (and other makers) on the road by the day? With solid reasons for optimism, this trend is accelerating and the financial world is paying attention. Naturally, do expect chains of charging stations to sprout across the landscape soon.

Last month, Royal Dutch Shell acquired Amsterdam based ‘NewMotion’ which has Europe’s largest Electric Vehicles charging points with over 50,000 stations. This deal gives Shell immediate penetration into the charging market. NewMotion operates in 13 countries and is already rolling out fast EV charging points to its network of Shell gas stations. As we already know, high voltage charging stations able to recharge compatible electric vehicle in a few minutes.

In 2018 expect other majors to join in the build out of electric charging stations – which will in turn compel more sales of electric vehicles.

The Fight over control of the US electrical grid

Back in June we reported that Blackstone Group LP and Prince Mohammed bin Salman of Saudi Arabia inked a deal allowing Saudi Arabia’s sovereign wealth fund to invest $100 billion dollar in US infrastructure. In the following days, for the brave reporting, we received monumental flak from many trolls in Riyadh. That wouldn’t cease us from ferreting out the truth, be assured.

The bitter irony is that, under the guise of “modernizing” the US infrastructure, the Trump administration is, in reality, busy in the process of privatizing power transmission lines in 20 western states currently operated by the Federal Government.

Among the budget proposals of President Trump was the plan to privatize publicly owned transmission assets, chief among them the assets of Bonneville Power Administration (BPA). Take the case of BPA itself, the system manages a high-voltage transmission grid that distributes power from 31 hydroelectric dams to provide electricity to more than twelve million people. This sell off, along with other assets of the Power Marketing Administration, is expected to save $5.5 billion. The rub is that the saving would roll off slowly over the course of a decade, if it does at all. As things stand, President Trump enjoys a cozy relationship with Prince M.M.S., swooning so far as to plead with the Saudis to list the IPO of Aramco on the New York Stock Exchange.

No guesses as to who will buy the assets, then. So, with dubious effects, this plan will hand over control to the Sandi Kingdom one of the most important strategic assets and chore engine of American innovation: electrical power in the western states, the same – currently inexpensive – power that make Google, Facebook, Data Centers and the Silicon Valley competitive. Every which way, expect both your power and internet bills to surge in 2018 should this proceed. Meanwhile, is privatization of the electric grid the norm everywhere? In the case of Saudi Arabia, the massive $300 billion privatization programme is moving slower than the slowest snail. As far as the power sector is concerned, 2018 is earmarked for the said privatization in the Kingdom. The rider is that the companies would be corporatized before the privatization process takes place. Would that happen to Saudi Arabia in 2050? Possibly.

Back to the US, with the foreseeable advent of electric vehicles, power transmission lines will play an important and strategic role in the US economy. Handing partial control of it to Saudi Arabia is a bad idea.

Expect this issue to become even more pressing in 2018 as awareness spreads.

Norway hailed as Energy thought leader

Norway is the biggest oil producer in Western Europe. According to the latest figures available as of October 2017, production stood at 1,901,000 barrels of oil on a daily average. Naturally, the profits ought to be considerable too. But that isn’t such a big surprise since there are many more countries with better oil production, right? Notwithstanding, there’s some difference when we take the case of Norway.

Unlike Saudi Arabia, Venezuela and to some level England, Norway hasn’t squandered away its income from fossil fuel but has been diligently investing the profit in a sovereign wealth fund for years. The fund has been investing heavily in stocks owning shares in more than 9, 000 companies around the world. In 2018, Norway’s sovereign fund is set to cross $1 trillion. That is, roughly the size of Mexico’s economy, making it by far the largest sovereign fund in the world.

First and foremost, Norway shows that anything is possible. Scandinavian self-control and discipline has allowed Norway to cultivate a dynamic competitive economy in spite of being a major oil producer. Unlike other major oil producers such as Saudi Arabia and Venezuela, wealth is fairly equally distributed and both genders are first class citizens.

As a result, Norway is becoming an energy thought leader, a shiny beacon everyone looks up to.

Fact: The country is a leader in electric cars. In June, 42% of new cars sold in Norway were electric, up from 37% in January 2017. With many new models entering Norway in 2018, the figures are set to rise. By contrast only 1% of US cars sold are electric. What begs the difference? The 2000 free charging stations in Oslo funded by sovereign fund, entirely funded by Norway’s oil and gas industry, could be it. It’s a shift in funding, with the money flowing from oil & gas to electric.

In true diversification, Norway has decided to let go of some of its oil and gas stock from the fund. Seems like Norway has learnt its lesson from the oil crash (beginning in 2014) as a result of which 50,000 jobs were cut. Nevertheless, a bold move since in the third quarter of 2017, the oil and gas stocks fared brilliantly for the fund with 8.7% return. The fund owns more than $5 billion in shares of Shell and received handsome returns when it became the best performing stock for the above period.

Norway’s duality – extracting large amounts of fossil fuels for export, while cultivating and projecting the image of a post-oil eco-friendly society is a marketing tour-de-force which inspires many – much like Elon Musk’s Gigafactory.

This comes at a time when the Oil & Gas Industry is facing a severe image crisis. As westerners are becoming more and more dubious of manufactured news, Norway’s open and altruistic approach which does not reek of propaganda or cronyism inspires many. Yet Norway’s Oil & Gas industry, far from slowing down, is pumping away and the one financing this quasi-utopian advancement with no negative PR.

So, come 2018, expect Norway’s accomplishments to be echoed even more vividly as people grow wary of fake news, lobbyist and Russian-sponsored rumors with political agendas. By contrast, Norway’s Oil & Gas industry’s altruistic approach will influence many. We are not talking just lifestyle decisions; we are including policymakers and large investors as well.

Conclusion

In the brand new year, you’ll see Russia’s star rising along the horizon enough to eclipse OPEC. After years of world dominance, Saudi Arabia’s influence will dwindle in the oil world. In the US, Riyadh’s investment in infrastructure will raise many more red flags. On an exciting and cheerful note, we see on the cards a marked shift towards electric vehicles next year. Distinctly, a phenomenal opportunity to invest in electric cars and charging stations is up for grabs. The decision, ever as often, rests on your shoulders. On that note, as the actual events supplement our predictions, do let us know.

Right, we’ve cracked open 2018 for you. Have a great one.