Image credit: shipacarinc

The recent escalation of attacks by Yemen’s Houthi militants on merchant ships at the entrance to the Suez Canal has sent ripples through the global trade network, impacting various industries. One sector facing unique challenges is the European electric vehicle (EV) market, already grappling with stiff competition from Chinese players.

Red Sea Crisis: A Bump in the Road for European EV Makers

The Red Sea crisis might seem like an opportunity for Europe’s troubled EV manufacturers to gain an edge, given the disruption it causes to the Suez Canal route, a vital link with Asia. However, for major players like Volkswagen (VW), Stellantis, and Renault, the situation doesn’t appear to be a game-changer.

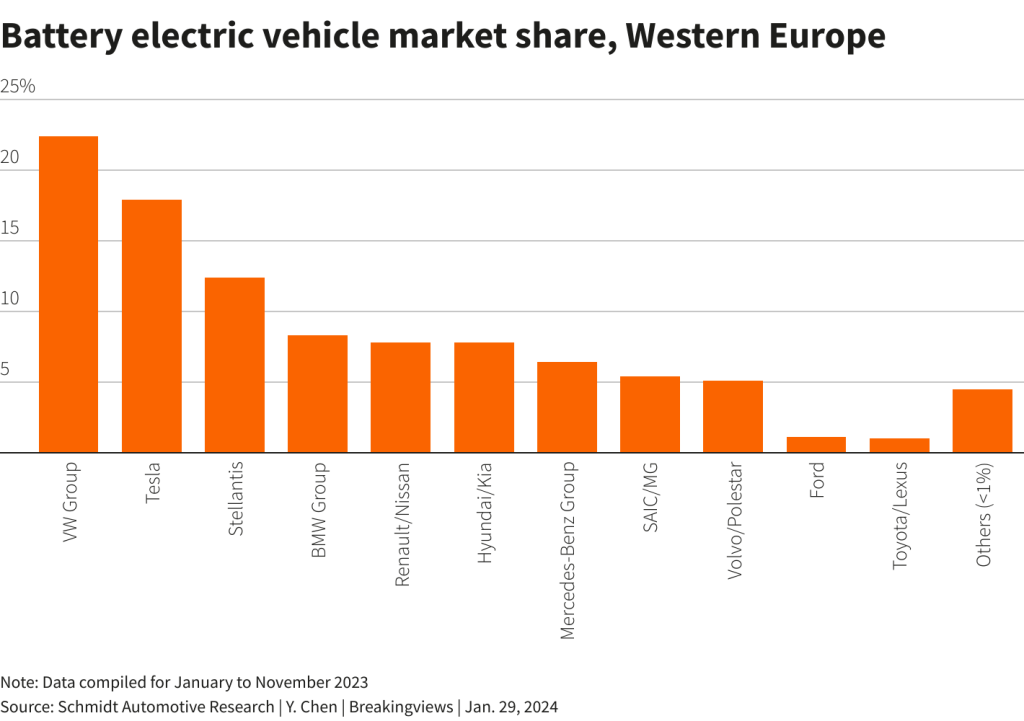

According to Schmidt Automotive Research, VW currently holds a 22% market share, making it Western Europe’s battery EV leader. Yet, Chinese-owned brands like SAIC Motor’s MG, BYD, and Nio are poised to nearly double their European market share to 15% by 2025, as projected by the European Union.

Complications in Trade Flow

The Red Sea blockages add complexity to the trade flow, particularly for Chinese EV exporters using ro-ro ships. These roll-on, roll-off vessels are already in short supply due to pandemic-related scrapping of older ships in 2020. Daily charter prices have surged to a record $120,000, making it six times higher than in 2019 and 20% more than before the Oct. 7 attacks by Hamas militants.

Major car carriers like Japan’s Nippon Yusen (NYK Line) are now avoiding the Red Sea. A detour via Africa instead of the Suez Canal adds 10 to 20 days to the voyage, significantly impacting an industry where top manufacturers maintain average inventories of only 54 days of sales.

Financial Implications for European Carmakers

The extended travel times and increased freight rates resulting from the Red Sea crisis mean additional costs for European automakers. Calculations indicate at least $1.2 million added to freight rates for a ro-ro with a shipping capacity of 5,000 cars, or $240 per car. This, coupled with higher insurance and fuel costs, may elevate the price per vehicle by an additional $350.

Price Gap Challenges

Despite these challenges, Chinese EVs remain substantially cheaper than their European counterparts. The average retail cost of a Europe-made EV is approximately $61,000, while high-end Chinese models, like the BYD Seal, only cost around $45,000.

Tariffs and Trade Dynamics

The EU’s anti-subsidy tariffs on Chinese EVs might impact the pricing dynamics. Even if Brussels were to raise tariffs from 10% to 25%, the resulting price increase for BYD’s EVs would still keep them competitive, reaching around $50,000. However, the broader threat lies in the reliance of European manufacturers on Asian suppliers, particularly for 70% of the batteries powering their EVs.

A Long Road Ahead

In conclusion, while the Red Sea strife may offer some breathing space for European EV makers, it doesn’t fully offset the broader threat from Chinese competition. The likelihood is that it will take longer for EVs in the bloc to become cost-competitive with petrol car sales by 2035, the Suez blockage’s most significant auto legacy may be a delayed transition to electric vehicles.

Source: reuters